What did your parents’ retirement look like? Did one or both work someplace for 40 and maybe even 50 years, then retire? If so, did they have a pension and Social Security to support them in their retirement? Go back even further…what did your grandparent’s retirement look like? Was it like the one described above?

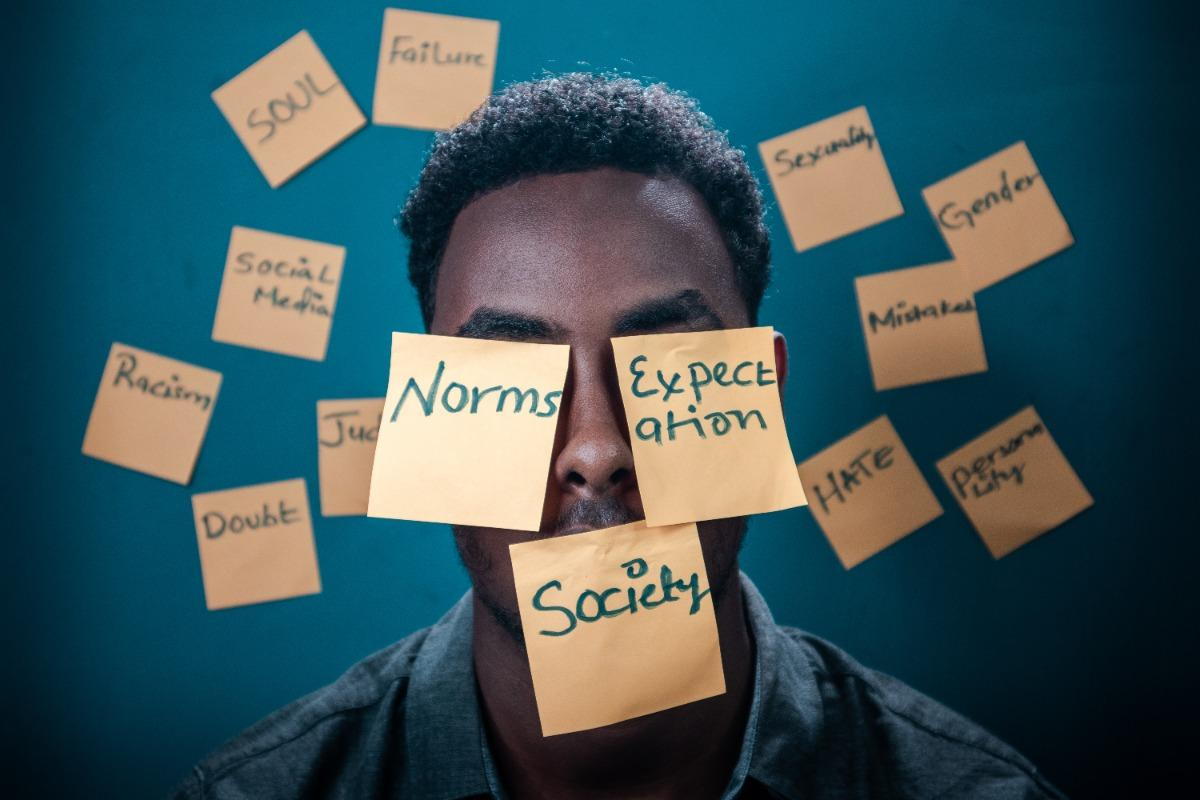

It’s hard sometimes for us to realize it, but cultural norms can drive our behaviors because we’ve come to accept them as, “just the way things are.” Defined as “…a societal rule, value, or standard that delineates an accepted and appropriate behavior within a culture[i],” these unspoken and unwritten standards can tell us that our decisions are going to be seen by others as right or wrong. The problem is cultural norms don’t always keep up with reality and we don’t often realize that we have a choice in whether to adhere to them.

In their book, “Retirement Your Way,” authors Gail McDonald and Marilyn Bushey highlight how our cultures, family members and friends can all influence us to make next chapter decisions based on what we’re ‘supposed to do.’ However, the reality of what traditional retirement has looked like has changed. For one thing, retiring with a pension is happening less and less with the rise of defined contribution plans like 401(k)s. According to the Bureau of Labor & Statistics, participation in traditional pension plans fell from 38% to 20% from 1980 to 2008 while participation in defined contribution plans grew from 8% to 31%.[ii] Another new reality is that generally, we’re living longer. As McDonald & Bushey highlight, the life expectancy for American men was 58 when Social Security was instituted and quite frankly, very few women then retired. Fast forward to the 21st Century and more women than ever are eligible to retire from their years of professional contributions and the average man or woman who lives to their mid-60s will likely live another 20 years.[iii]

As you contemplate your next chapter it pays to realize that you have options, which I’ve discussed in an earlier piece.[iv] It also pays to reflect on how cultural norms might be influencing your decisions. Do you really have to do what your parents or grandparents did? What would it be like to ‘buck the trend’ and follow a different path than your friends, family or coworkers think you should? How are cultural norms influencing your decisions, and finally what might it be like to let go of them?

[i] https://dictionary.apa.org/cultural-norm

[ii] https://www.cnbc.com/2021/03/24/how-401k-brought-about-the-death-of-pensions.html#:~:text=401(k)%20and%20other%20defined,the%20Bureau%20of%20Labor%20Statistics

[iv] https://www.jallenleadership.com/blog/488424-choosing-a-retirement-category-you-have-options